For the next days and perhaps weeks there will be palaver about how effective the policies of the Barbados Labour Paty (BLP) have been since taking up the office. The conversation is reminiscent to what follows the annual 11+ exam. It is a must do exercise for ‘stakeholders’- including the media- to purge themselves of any accusation of not delivering on the mandate.

Given the perilous state Barbados finds itself both on the economic and social fronts, it is a challenge to speak with certainty whether measures implemented so far by the one year old government are gaining traction.

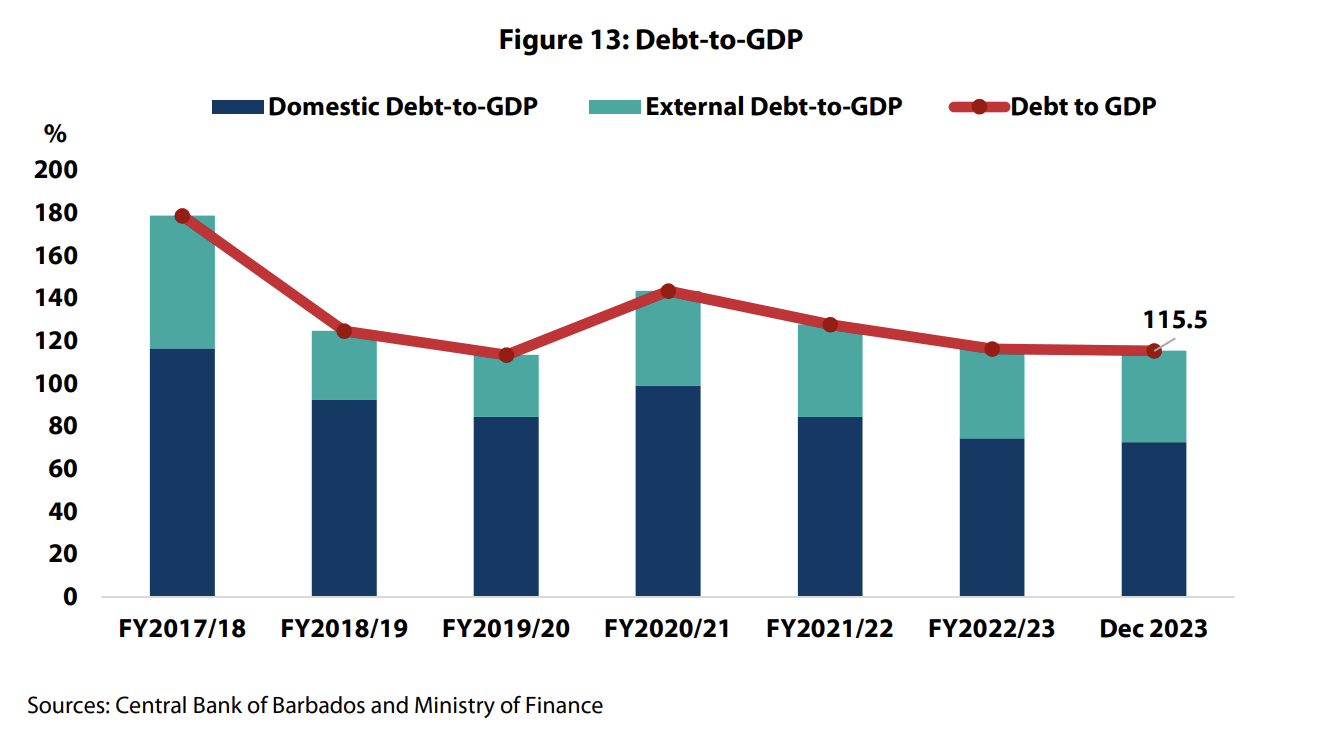

If you separate the political noise- loud as it is- there is justifiable concern that although the Mottley government has been active by attempting to tackle the gargantuan debt situation by restructuring, moving with urgency to apply a temporary fix to the sewage issue on the south coast, rationalizing SOEs, drawing-down development loans to fix crumbling infrastructure, dusting off out dated Town Planing legislation, addressing thorny issues like local and regional Transportation (LIAT, Transport Board), breathing life back into brand Barbados by increasing visibility on the regional and international spaces. This is not meant to be exhaustive. A review of the BGIS portal archives can assist with listing government’s effort to date.

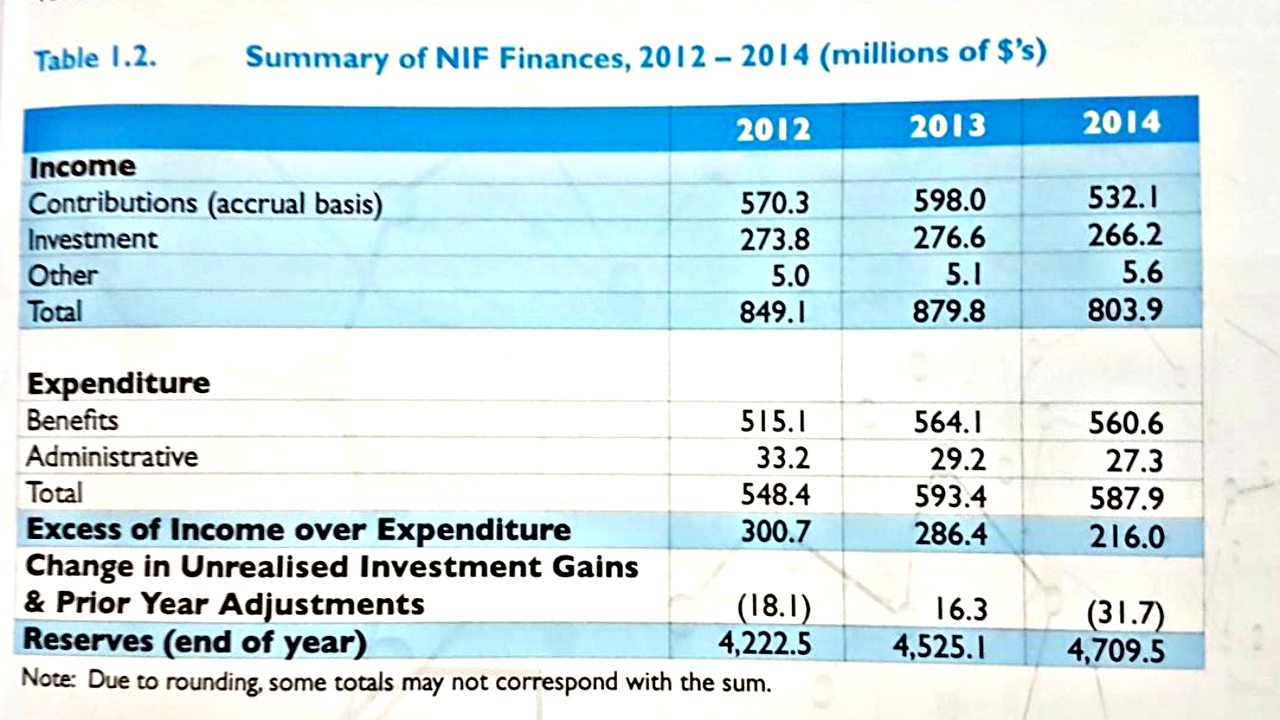

A concern of the blogmaster however is a lack of similar energy as it relates to communicating the state of the National Insurance Scheme (NIS), operationalizing a transparency framework to include Integrity (anti-corruption) in public life, FOIA, political campaign financing, a relevant Public Accounts Committee, Auditor General’s office and related projects.

This concern about the NIS was heightened with a recent public assurance delivered by Chairman Ian Gooding-Edghill that the NIS is financially healthy. What does his statement mean if we compare to a 2017 IMF report – NIS Reserves Projected by IMF to be Exhausted in 2037 – UPP Candidate Craig Harewood Muted by VoB?

Government needs to do more to encourage people to become investors and create ä Barbados that works for Barbadians – President, Barbados Economic Society

In a related matter is is encouraging to listen to Opposition spokeswoman on economic affairs Senator Cristal Drakes not intimidated to discuss the pros and cons of devaluing the Barbados dollar. Her position was supported – not directly – by President of the Barbados Economic Society (BEC) Simon Naitram. He is on public record promising to dispassionately debate the issue on the BEC website in the coming weeks.

Sorry to disappoint a few members of the BU family who will want to look at the numbers from all angles. Not to forget about the social fabric of the society also busting at the seam. Has the time come for us to focus more on the Vision/Strategy positions of our governments? If we hold our leaders accountable for the Vision the supporting tactics may be better understood. What is the REAL Vision/Strategy of the government for Barbados?

The blogmaster is unable to grade the government A, B, C or D at this stage. To use a race horse analogy – the horse has ‘lathered’ nicely in the paddock before the race, outcome unknown.

The blogmaster invites you to join the discussion.