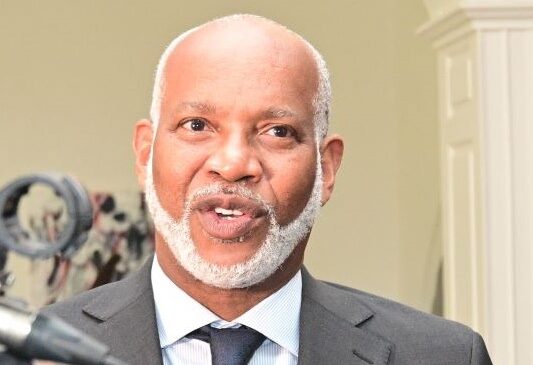

Governor Cleviston Haynes delivers the Central Bank of Barbados’ review of Barbados’ economic performance in 2019 and takes questions from the media and the live online audience.

Central Bank of Barbados’ Review of the Barbados Economy in 2019.pdf (4.16 MB)

The blogmaster invites you to join the discussion.