The BU household has been following the rise of blockchain technology with great interest. Obviously it is technology at a nascent stage and it is the venture capitalists and early adopters who have the task of ‘selling’ a new payment mechanism to the population.

The BU household has been following the rise of blockchain technology with great interest. Obviously it is technology at a nascent stage and it is the venture capitalists and early adopters who have the task of ‘selling’ a new payment mechanism to the population.

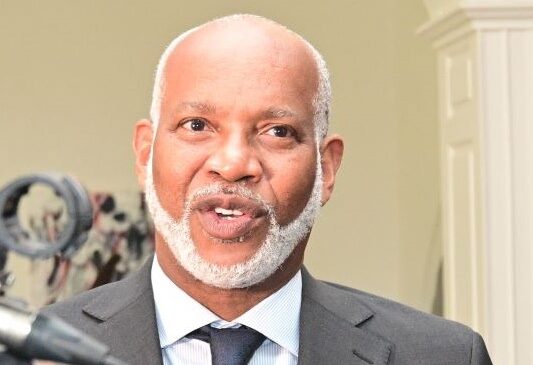

The BU household will continue to monitor the progress of the technology and wish Rawdon Adams every success who is the newly appointed CEO of Bitt.com. We have a lot of respect for Rawdon, the BU family should recall he has contributed to the BU forum in the past. He joins Marla Dukharan at Bitt.com where another person we have a lot of respect was recently added to the team to lead the charge.

The Barbados directorate should take note that the OECS sub-region has signed up with Bitt.com to pilot the technology.

The following article extracted from Coindesk.com.

Barbados Underground

Bitt, the blockchain payments startup backed by Overstock’s Medici Ventures, has announced the hiring of a new chief executive officer.

The new CEO, Rawdon Adams, takes the helm of the Barbados-based startup just months after it unveiled an ambitious plan to develop a pan-Caribbean settlement network built with blockchain tech. The plan, Bitt said in May, is to create a way to better connect a region with more than a dozen governments, each with their own currency systems.

The startup has also worked with the Central Bank of Barbados on pilot blockchain initiatives.

The appointment of Adams adds heft to the startup’s regional plans. Rawdon is the son of Tom Adams, who served as the country’s prime minister between 1976 and 1985. Tom Adams, in turn, was the son of Sir Grantley Herbert Adams, the first and only prime minister of the former West Indies Federation.

According to LinkedIn, Rawdon previously worked as an analyst for GE Medical Systems and founded market arbitrage software startup ArbMaker in 2008.

Jonathan Johnson, president of Medici Ventures, said in a statement:

“Rawdon is the perfect leader to grow and scale Bitt to the next level and bring to fruition Bitt’s initial vision in the Caribbean.”

Overstock, through Medici, invested $4 million in Bitt in April of last year.

Editor’s Note: This report has been updated for clarity.

The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Have breaking news or a story tip to send to our journalists? Contact us at news@coindesk.com

.

The blogmaster invites you to join the discussion.