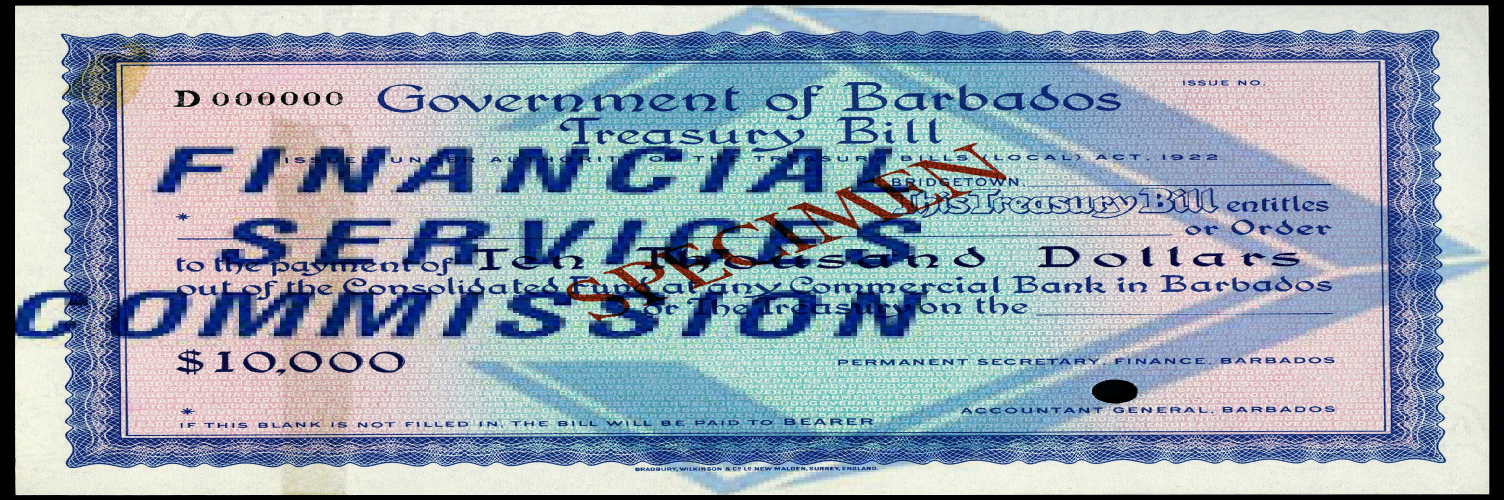

The decision by the Financial Services Commission (FSC) to suspend trading in government securities effective 5 July 2018, although routine based on government’s decision to default on debt, the implications will not be. If the unconfirmed news that Avinash Persaud is the Chairman of the FSC, it is understandable why Prime Minister Mia Mottley prefers a team player. The blogmaster understands the routine of the changing of the Boards once a new government or Minister takes charge although there is nothing that would have prevented his reappointment.

The blogmaster invites you to join the discussion.