Submitted by Wily Coyote

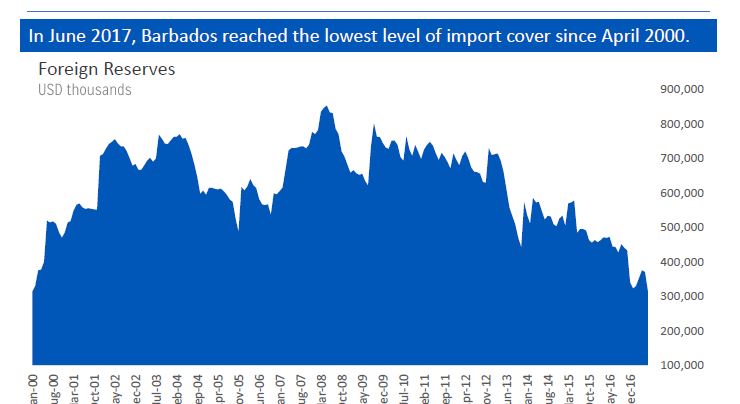

Barbados has been experiencing a significant reduction in their Foreign Currency Reserves over the last several years. The reserves are presently at about 4 weeks, this should be noticeable with shortages of goods within the island, however this is not the case. One would have to ask why this is; a shortage of foreign currency should limit the purchase of imported goods and result in shortages. There are likely several reasons for this to be happening in Barbados with respect to imported goods.

Barbados has been experiencing a significant reduction in their Foreign Currency Reserves over the last several years. The reserves are presently at about 4 weeks, this should be noticeable with shortages of goods within the island, however this is not the case. One would have to ask why this is; a shortage of foreign currency should limit the purchase of imported goods and result in shortages. There are likely several reasons for this to be happening in Barbados with respect to imported goods.

-

Concessions to large Foreign owned business, Sandals, Cost U Less, Sandy Lane etc. result in no Foreign Currency inflows from these businesses which allow these companies to operate outside currency controls, and

-

Large retailers domiciled outside of Barbados i.e. Massy, Cave Sheppard, Sagicor etc. have the capacity to purchase their goods outside the controls of Barbados currency regulations and then import their goods into Barbados with foreign exchange immunity, and

-

World tourism commerce is no longer transacted in the visited country, i.e. Foreign tourist buys a vacation package to Barbados in France, pays a travel agency, airline etc. in France with Euros. This French agency now pays another off Shore Company in USA which represents the accommodation provider in Barbados to their off shore account. So far none of this Foreign Currency has reached Barbados. This off shore provider who represents the Barbarian supplier will now transfer to Barbados ONLY the COST portion of the Barbadian supplier. In years past all of these transactions would have taken place in Barbados with foreign currency.

These Foreign Currency transactions do not significantly impact these Barbadian businesses; it does however directly impact all Barbados government offshore transactions as they need Foreign Currency to pay for all their goods and services. Lots of foreign currency outflows with limited inflows results in Foreign Currency Reserves being depleted and not replaced.

Pegging the Barbados currency to an individual Foreign Currency is no longer practical in this new age of world commerce. Pegging to a basket of foreign currencies maybe a solution, however this scenario is also fraught with significant risks. Barbados best solution is

-

reduce government expenditures,

-

increase productivity,

-

reduce the payroll significantly (50%), all civil service promotions done on merit,

-

eliminate 70% of the state owned enterprises,

-

privatize potentially profitable SOE’s to NOT FOR PROFIT companies/corporations,

-

drastically improve efficiencies within government,

-

have all SOE’s maintain financials and be audited annually,

-

remove life pensions for government ministers,

-

implement a MEANS TEST for all government social payouts,

-

run a balanced budget,

-

country must learn to feed themselves without relying on food imports, and

-

FLOAT the currency.

In order for the above to be implemented Barbados will need the IMF’s financial assistance and more importantly IMF DIRECTION, MONITORING, MEETING SET OUT GOALS, TIMETABLES and BIG STICK SUPERVISION. Barbados dire financial situation requires drastic adjustments to Bajan lifestyles and government operations. Barbadians must start to live within their mean.

The Featured image is a Marla Duckaran chart.

The blogmaster invites you to join the discussion.