My previous article examined the November 2007 appointment of Karen Nunez-Tesheira as our Minister of Finance by then PM, the late Patrick Manning. For whatever reason, the consternation over the appointment of Christian Mouttet to investigate the #ferrygate imbroglio is reminding me of the confusion many people felt when PM Manning made that appointment. An eerie echo from the past, in this, The Season of Reflection.

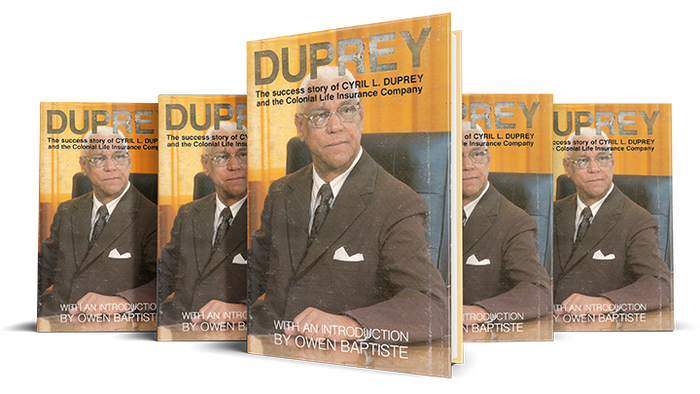

This article appears the day before the anniversary of T&T’s 55th Independence Day. This week I examine the recent claims by the CLF group and its supporters as to its Black origin and so on. Those claims can be summarised as:

Read full text of Afra Raymond’s article

Leave a Reply to Hal AustinCancel reply