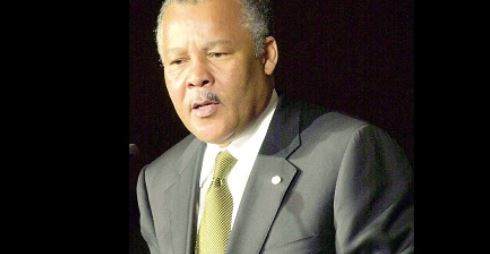

For many one of the enduring memories from the Owen Arthur Barbados Labour Party (BLP) tenure is the sale of the Barbados National Bank (BNB) to the Trinidad based Republic Bank Limited. Arthur continues to defend his decision by offering that the BNB was a loss making entity hamstrung by a high level of government bureaucracy and non performing loans. Further, he explains that local credit unions and locals spurned the opportunity to buy shares when offered.

Many will debate the pros and cons of Arthur’s decision to shed majority interest in the BNB till thy kingdom come. We live in a world where almost if not all decisions are greatly influenced by economic consideration. Such an approach does not allow the space for a people to craft a vision and identity based on symbols, traditions that include even the spiritual and other non economic factors. Through the eyes of the BU household the BNB was a symbol of the progress Barbados had made from transitioning the economy from agrarian. It represented how majority Black Barbadians were in control of a significant financial intuition on Broad Street. If one wants to be political with the argument, it exposed the Barbados Labour Party (BLP) philosophy of reordering the economic fundamentals of the economy to make Barbados competitive in a competitive global world. The ease with which Black politicians- Owen Arthur as lead -disposed of what BNB should give cause for Barbadians to pause. The decision by Arthur is analogous to the Stuart DLP government dismantling its philosophy to provide ‘free’ education as a pathway for future development and empower a small Black nation.

It was interesting to listen to former Prime Minister of St. Kitts Denzel Douglas explain a few of the strategies he presided over that have led to the transformation of the St. Kitts economy. He stated that the St. Kitts-Nevis-Anguilla National Bank was important to the strategy of restructuring the debt because the government was able to intervene in the domestic financial market to align with the national interest. Given the current economic state of Barbados the government does not have the recourse of a local bank to borrow from an important best practice that was reportedly implemented successfully in St. Kitts and Nevis.

BU supports the view that a national bank is important to any nation to shore-up the sovereignty argument. One cannot be truly liberated as a people if the gateways to important arteries in the society are controlled by foreign interest. In the case of Barbados the banking sector is 100% controlled by foreign ownership. The food sector is 90 plus percent controlled by non Barbadian interest. The supply of electricity is controlled by foreign interest. In the three examples –the financial, food importation and distribution and power, a so called independent people have no control. We acknowledge that the Fair Trading Commission and government agencies were established to regulate the market in the interest of all stakeholders including the consumer .

The lengthy preamble is meant to introduce a recent development in Canada where the banks- locally owned -have agreed to pool resources in the interest of the country.

Canada’s biggest banks and insurance companies have launched a private-sector fund of up to $1 billion to provide long-term financing to burgeoning high-growth businesses, the firms announced Thursday. The Canadian Business Growth Fund will look to invest the full amount over 10 years, with an expected initial commitment of more than $500-million.

Canada’s banks and lifecos launch fund of up to $1 billion to help businesses grow

There is no need to be prolix to emphasize the point that home drums beat first. For non Barbadian owners of business enterprises in Barbados –where is home?

Leave a Reply to Vincent HaynesCancel reply