Royal Bank of Canada, Bank of Nova Scotia and Canadian Imperial Bank of Commerce are by far the Caribbean’s three largest lenders, dominating both personal and commercial banking. Combined, they’ve written off more than $1 billion […] in the region since the Great Recession – The Globe and Mail

The government through its agent the Central Bank of Barbados removed in April 2015, the regulation for commercial banks to maintain a minimum savings rate. The immediate response by at least one bank was to lower the rate to .5%, the others were not far behind. The Central Bank to coincide with the announcement engaged in an aggressive advertising blitz to promote the benefits of holding government bonds. From all reports there was a good response by the public to the bond offer and government was quick to conclude it was a demonstration of confidence in government’s policies. BU is of the view the response by Barbadians was to the orchestrated strategy of dangling a higher interest rate bond offer a gullible public found too good to refuse.

From all reports the banking system in Barbados remains clogged with cash. In their defence the the banks will probably suggest good deals are hard to find; the state of the economy makes lending to the tourism and property unattractive, and lending to government given its protracted financial woes is not an option. The decision by the government to hoodwink Barbadians by borrowing from individuals [savings bonds] transfers the risk from commercial banks to the government. Former Prime Minister Owen Arthur asked the government at the time to make the public aware of what is at stake and described the bond offer as not a ‘worthwhile investment’. Time will tell if the idea of widening the banks margin by jettisoning the minimum savings rate will encourage a reduction in lending rates. Time will tell!

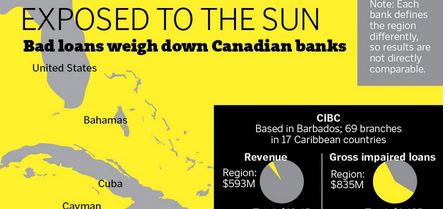

To better determine the level of confidence in the market, a better indicator to keep an eye on is the decisions being made by the Canadian banks in the Caribbean. In February 2015 an interesting article titled Trouble in Paradise: Inside Canadian banks’ billion-dollar Caribbean struggle was inserted into the public space. The message of the article was loud and clear, the Caribbean has become a bad place for Canadian banks to do business and shareholders are worried. Consequently, Canadians banks across the Caribbean have been ‘slimming’ operations which has seen branches being closed and long serving employees shown the door.

The Canadian banks have had a long association with the Caribbean dating back to the nineteenth century and have extracted enormous profits from the region – in the same way the former telecommunications behemoth Cable & Wireless found out, all good things eventually come to an end.

It is interesting to note one of the big three Canadians banks replaced its CEO Rik Parkhill. It is not unusual for the Canadian Banks to rotate green behind the ears Executives in the region. What is more interesting about Parkhill’s replacement this time around is his background in risk management. With an impaired loan portfolio approaching 50% it is obvious what Gary W. Brown’s mandate from senior executive is: clean up the balance sheet and make ready for sale.

Not a vote of confidence in doing business in Barbados AND the rest of the Caribbean eh?

The blogmaster invites you to join the discussion.