A story that is a blight on the landscape of Barbados and will never grows old – Blogmaster

Dear Mr. Leacock,

I am a citizen and taxpayer of Barbados. I am also a pension actuary.

My fundamental responsibility, as an actuary, is to provide services skilfully and competently, to operate with integrity, and to uphold and protect the public trust. I believe your chosen profession has imposed similar responsibilities upon you. By definition, therefore, whenever the public trust is involved, your objectives and mine are always convergent.

For the past couple of years, I have watched in dismay as pieces of information doled out for public consumption revealed how a major life insurance company operating in Barbados was stripped of almost four hundred million dollars of its assets.

Barbadian observers have recoiled in sheer disgust and anger as evidence from reliable sources suggest that our laws were systematically and disdainfully trampled by a group of persons, some of whom masqueraded as executive managers of the ill-fated insurance company, and some of whom pretended to be statesmen.

Many citizens deeply believe that any villains involved in this sordid raid of a life insurance company’s assets should be brought to justice. They also believe that a serious effort should be made to recover as much of the diverted policyholders’ premiums as possible. I share the views and concerns of those citizens, but so far, I have noticed that the boisterous and unified cries clamouring for justice appear to be falling on deaf ears.

Sir, I know that you are a very busy man, presumably dealing with far heavier legal matters than this one, who probably have not found enough time to tackle this problem as yet. Nevertheless, I have decided to construct and package some of the major arguments advanced from various quarters, which support the prosecution of this case before the law courts. I now attach and present them to you, along with the errors that would naturally flow from a mind with no legal training whatsoever.

I fervently hope that your reply to me will give an indication as to whether you believe the ‘evidence’ in this case to be lacking in substance, or whether you think it is credible enough for your department to pursue legal action against the wrongdoers.

We need to reach out to the United States, the United Kingdom, and Canada, our major international trading partners, to make them aware of the extent to which our traditional Barbadian values of respect for law, honesty, and hard work are being relentlessly eroded at the corporate and political level. We also must alert them to the fact, that, when it comes to combating white-collar criminality and corruption, Barbadian citizens currently feel that they will have to rely on international assistance in one form or another, since no help ever seems to come from the local governmental agencies.

BACKGROUND

In 2009, Mr. Lawrence Duprey, head of the largest regional insurance company in the Caribbean, approached the Central Bank of Trinidad & Tobago and asked for a loan to assist his company with paying its bills. That request, and the implied financial horror associated with it, emitted scandalous shockwaves that reverberated throughout the West Indian financial and retirement communities. By the time the dust had settled, Trinidadian taxpayers were forced to part with TT$22 billion to restore some semblance of stability to the Colonial Life Insurance Company (CLICO) of Trinidad & Tobago.

Recognizing that the value and security of the life insurance policies purchased by their citizens from CLICO Barbados were now exposed to the dangers of systemic risk, the Prime Ministers of the other Caribbean islands became quite solicitous and agitated. Mr. David Thompson, on the other hand, as Prime Minister of Barbados and Minister of Finance, was actually enjoying a lucrative but shady relationship with the subsidiary CLICO Barbados group of companies. To safeguard whatever personal and financial benefits he was surreptitiously receiving through his unscrupulous business dealings with Mr. Leroy Parris and other executive members of CLICO, the Prime Minister of Barbados had to invent a charade which would also quell the rising fears and doubts of his fellow Prime Ministers from the Windward and Leeward Islands.

In response to the nervousness and uneasiness coming from Caribbean leaders and citizens, the Thompson-led Barbados Government assured everyone that there was a qualitative difference between CLICO Trinidad and CLICO International Life Insurance Limited (CIL) of Barbados. CIL was being managed well, declared the government’s propaganda machinery. Most interestingly, the Governor of the Central Bank at the time went on to inform Barbadians that CIL had not asked for any assistance, but the Government of Barbados was going to “ put its money where its mouth is” by giving BDS$10 million to the insurance company.

The charade had now masterfully crafted a one-way conduit so that $10 million of Barbadian taxpayers’ money could flow into CIL’s account. Generally speaking, once money entered the CIL account, Mr. Leroy Parris’ first step was to take control of it. Next, with the assistance and facilitation of executive management, he diverted it away from the insurance company and channelled it towards whatever uses he deemed fit.

Of course, the whole narrative related to CIL being a well-managed insurance company was merely a convenient fabrication. So much so, that no one was really surprised when CIL, drained of significant amounts of its assets, eventually collapsed into the arms of Court-appointed Judicial Managers.

At present, no one knows how much taxpayers’ money will be needed to bring some stability and confidence back to the Barbadian insurance market. What everyone knows, however, is that the despicable and horrendous behaviour of the principal actors in this scandal has caused irreparable damage to the international reputation and brand of Barbados.

INFORMATION IN THE PUBLIC DOMAIN:

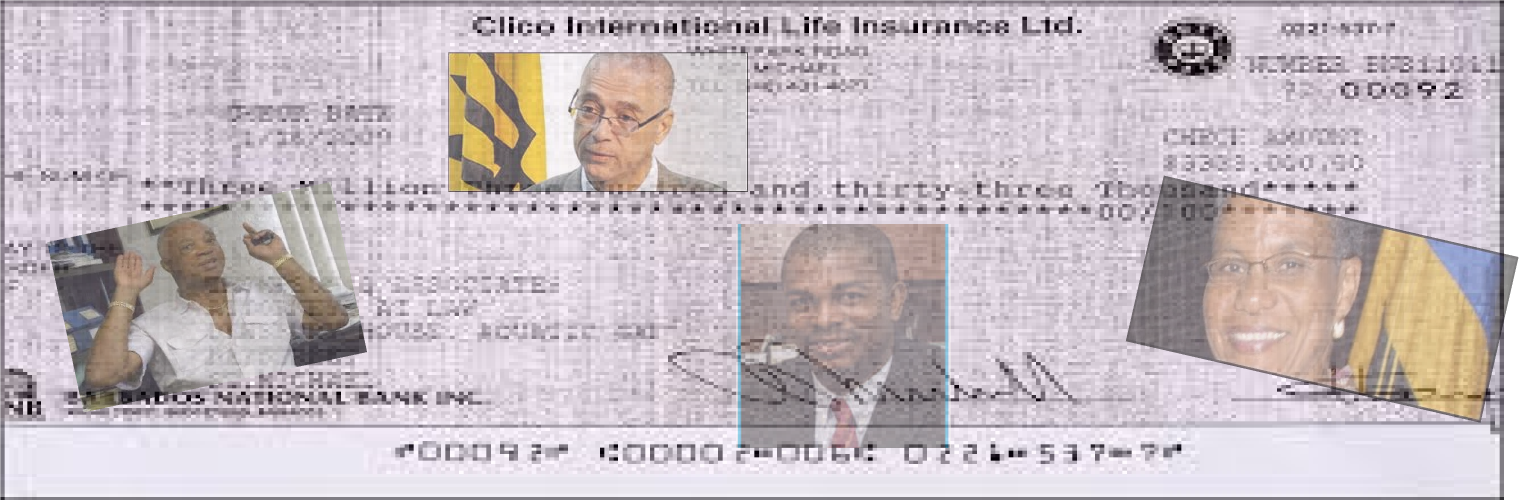

In December 2008, an invoice for BDS$3.333 million was submitted for payment by the law firm of Thompson & Associates to CLICO Holdings (Barbados) Limited (CHBL) purportedly for the provision of legal services. The invoice, making its first public appearance on a political platform two days before the 2013 General Election in Barbados, was approved by Mr. Leroy Parris who was Chairman of CHBL.

Mr. Leroy Parris used his corporate position to get CIL to issue a cheque for BDS$3.333 million dollars payable to Thompson & Associates. The cheque publicly appeared on the same date, and in the same fashion, as the invoice. One of the signatures on the CIL cheque belonged to Mr. Terrence Thornhill, an accountant by profession, and President of CHBL.

Mind you, CIL was not involved in the transaction, did not receive any legal services, and therefore had no accounting or legal right to pay Thompson & Associates for the provision of such services.

The invoice from Thompson & Associates showed a charge of $250,000 for some legal work done by Mr. Maurice King. Mr. King reportedly denied doing such work. In the face of such a denial, the $250,000 which was removed from the assets of CIL would have been removed under false pretences. This false claim would have been initiated by Thompson & Associates.

It should be noted that in 2008, Mr. David Thompson, perceived head and owner of Thompson & Associates, was also Prime Minister of Barbados and Minister of Finance. Mr. Leroy Parris was the Chairman of CHBL and CIL. Mr. Terrence Thornhill was a professional accountant, and President of CHBL.

All over the world, Value Added Tax (VAT) administrators have to struggle against the scourge of carousel fraud, a criminal technique used by groups of businessmen and their businesses to complicate, hide, erase and offset transactions as a method of evading payments of VAT.

The transaction between CHBL and Thompson & Associates for the provision of legal services in 2008 would have attracted VAT at the rate of 15%. Therefore, the invoice from Thompson & Associates should have shown an amount of $499,950 as VAT due.

It did not.

Bear in mind that Mr. David Thompson, as Minister of Finance, would have also been the political head of the VAT department in 2008 and therefore had a legal obligation to protect government’s revenue. Furthermore, Prime Minister Thompson ought to have been concerned that money was being so easily diverted from a life insurance company to pay bills for another entity.

Mr. Leroy Parris, when he approved the invoice as Chairman of CHBL ought to have known that the transaction would have attracted a VAT rate of 15%.

Mr. Terrence Thornhill, as a professional accountant, must have known that an amount of $499,950 in VAT was due to the Government of Barbados as a result of the transaction.

Collusion had now taken place among CHBL, CIL, and Thompson & Associates as companies, and among Mr. Leroy Parris as Chairman of CIL & CHBL, Mr. David Thompson as Prime Minister of Barbados and Minister of Finance, and Mr. Terrence Thornhill, as a professional accountant and President of CHBL. The effect of this collusion would have been to keep VAT revenue amounting to $499,950 out of the hands of the Government of Barbados.

The way our VAT system works, the first transaction involving the invoice and payment for legal services was a terminal and independent transaction. There was no more value to be added once the company of Thompson and Associates was paid for its legal services.

It has been asserted by others that, although the check was written to Thompson & Associates, the 3.333 million dollars ended up in the hands of Mr. Leroy Parris as partial payment of a gratuity.

However, if the assertion is true, then it must be stressed that neither Thompson & Associates as a company, nor Mr. David Thompson as Prime Minister of Barbados, was in any position to legally pay Mr. Leroy Parris a gratuity. Under such circumstances, partial payment of a gratuity would have to be viewed as a false and illegal reason offered by Thompson & Associates, Prime Minister David Thompson, and Mr. Leroy Parris to cover up a multi-million dollar racket.

One cannot help but notice the depth of planning and collusion as the second phase of this scheme was put into action.

It must be emphasized that as far as VAT is concerned, this was a completely new transaction now taking place.

Since there were no physical goods involved, VAT legislation would have assumed that a service was provided by Mr. Leroy Parris in order for Thompson & Associates, or anyone for that matter, to pay him $3.333 million.

That service would have attracted $499,950 in VAT.

Therefore, the two independent transactions aimed at diverting $3.333 million from CIL into the personal account of Mr. Leroy Parris, should have brought $999,900 of VAT revenue into the coffers of government. Unfortunately, the actions of the principal participants in these transactions left a VAT department too petrified by fear of political victimization to act.

This information in the public arena shows clearly that Mr. Leroy Parris had no legal right to the $3.333 million of policyholders’ money that was paid into CIL as premiums.

This leads us to the following question: How can $3.333 million dollars end up in an account belonging to Mr. Leroy Parris, with no credible legal or accounting explanation being given for its arrival?

This feat could only have been achieved through one mechanism – money laundering. Money laundering is a crime in Barbados.

How many illegal and fictitious transactions were conceived and entered into by the principal actors, in order to quench the insatiable thirst of Mr. Parris, and others, for the premiums paid by CIL’s policyholders? How much of these transactions resulted in a transgression of our tax and money laundering laws? How much of the premiums paid by poor hard-working Barbadians and other West Indians to purchase insurance protection from CIL ended up in Prime Minister Thompson’s estate as kickbacks? How much of it supported the lavish and jet-set lifestyle of Prime Minister Thompson, Mr. Leroy Parris, and other executive members of CIL and CHBL?

It would be an extremely serious mistake for you to believe that these two transactions were random and isolated events. The truth of the matter is that, over time, significant sums of money (almost $400 million) were taken from CIL and diverted for the use of CHBL, its subsidiaries, and executive membership.

I am sure you would be shocked if you were to discover that no advance Board approval was given or secured for the divergence of these funds from CIL. Recognizing that Mr. Terrence Thornhill was a professional accountant and an executive member of CHBL, I am also confident that you would be absolutely appalled if you were to discover that no accounting documents could be readily found or made available to support or explain the divergence of almost $400 million from CIL.

Life insurance is a highly technical and esoteric business. At any point in time, the value of the total premiums paid on a policy by the policyholder, minus the total cost of insurance protection that he or she has received, represents a ‘reserve’ amount which must be calculated by an actuary and held by the insurance company. Insurance regulators worldwide establish levels of statutory reserves which insurance companies must keep on hand to ensure that benefits to policyholders can be paid as they fall due. These reserves are established by using extremely conservative actuarial assumptions which focus primarily on ensuring the solvency of the insurance company, and protecting the interests of policyholders.

Additionally, an insurance contract protects the interests of policyholders by making non-forfeiture options available to them whenever they decide to terminate a policy. One of these non-forfeiture options involves the calculation and payment of the policy’s cash value.

Establishing an adequate level of statutory reserves, determining when premium income is currently earned, and using policyholders’ premiums to pursue a prudent investment strategy aimed at matching the nature of assets with the nature of liabilities are some of the basic roles and responsibilities of the executive management of a life insurance company.

By failing to timely file reports on the reserve situation of CIL to the accommodating regulatory authorities in Barbados, and by habitually and illegally diverting assets away from CIL to other accounts, Mr. Leroy Parris and the executive membership of CHBL effectively destroyed the viability of CIL as an insurance company. In doing so, they brought immense financial and economic hardship to bear upon thousands and thousands of policyholders and life insurance agents across the Caribbean. As CIL thrashed about spasmodically in its death throes, terminating policyholders, despite being protected under the law, could not get the cash value of their policies as promised by their contracts.

There is one final twist to this strange eventful history.

In August 2009, the office of the Supervisor of Insurance issued a cease and desist order to CIL aimed at preventing the life insurance company from issuing new policies. Believing that their unholy alliance with the Prime Minister of Barbados rendered them untouchable by the law, Mr. Parris and some of the executive management of CIL and CHBL chose to treat the order by the office of the Supervisor of Insurance with the same level of contempt with which they treated the tax laws, insurance laws, corporate laws, and money laundering laws of Barbados.

In June 2010, Ms.Vernese Brathwaite, the Deputy Supervisor of Insurance, filed an official complaint urging the Commissioner of police to probe the illegal sale of over 800 life insurance policies which were sold despite the regulatory order issued the year before.

Any policyholder resident in the USA, Canada, Britain or any other overseas jurisdiction who received solicitations from CIL by mail, e-mail, or any other means after August 2009 urging them to purchase a life insurance policy, should take the evidence to their respective governments. Mail fraud would have been committed.

In February 2012, given the collaborative efforts between Ms. Vernese Brathwaite as Deputy Supervisor of Insurance, and Mr. Darwin Dottin as Commissioner of Police, charges were filed against Mr. Leroy Parris and Mr. Terrence Thornhill for violating the cease and desist order imposed by the office of the Supervisor of Insurance.

Ms. Vernese Brathwaite as Deputy Supervisor of Insurance, and Mr. Darwin Dottin as Commissioner of Police, have been unceremoniously removed from their desks. Neither explanation nor reason has been provided to the taxpayers of Barbados for the termination of the careers of these senior government officials.

As for the “cease and desist” case against Messrs. Leroy Parris and Terrence Thornhill, it has been adjourned without a set date after Mr. Parris failed to show up for his first scheduled court appearance.

Is Barbados on the road to becoming a banana republic?

The blogmaster invites you to join the discussion.